Trackrecord 2024 of $GORN DAO

The Gorn Hegemony DAO deploys a portfolio of uncorrelated asset strategies with the aim to outperform the market. In this issue of Gorn Trackrecord we will scrutinize the results of walk forward trading simulation in 2024

Introduction: a real money out-of-sample trading test

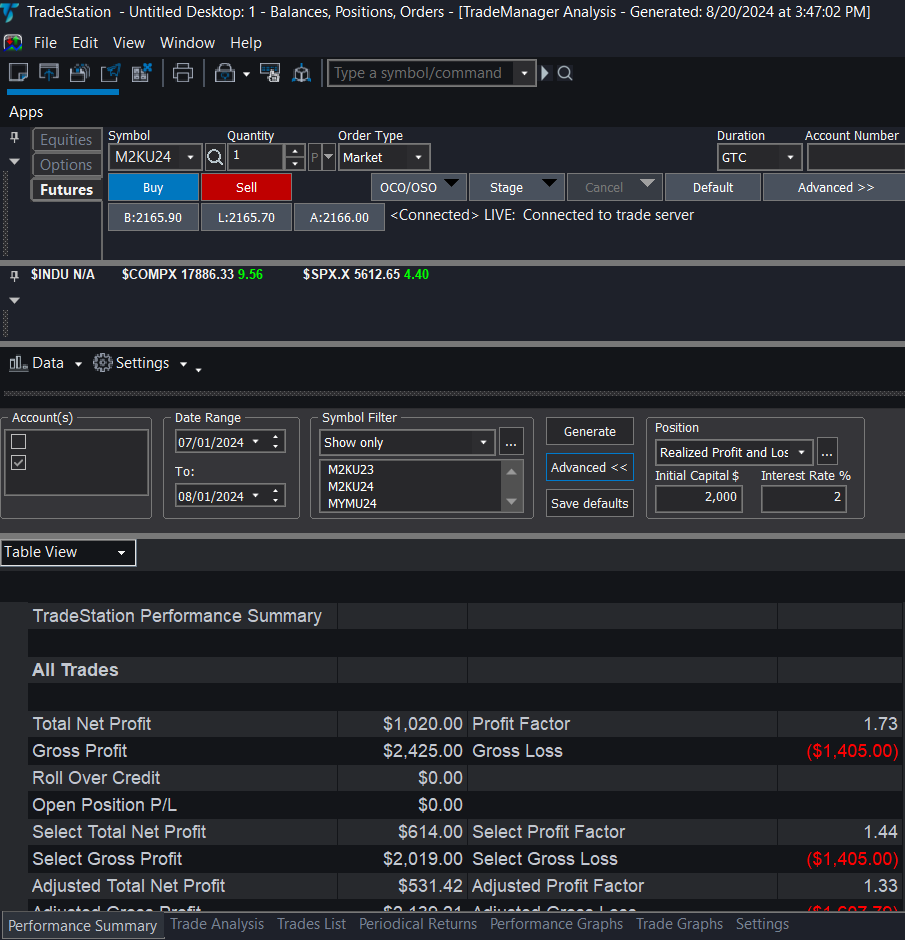

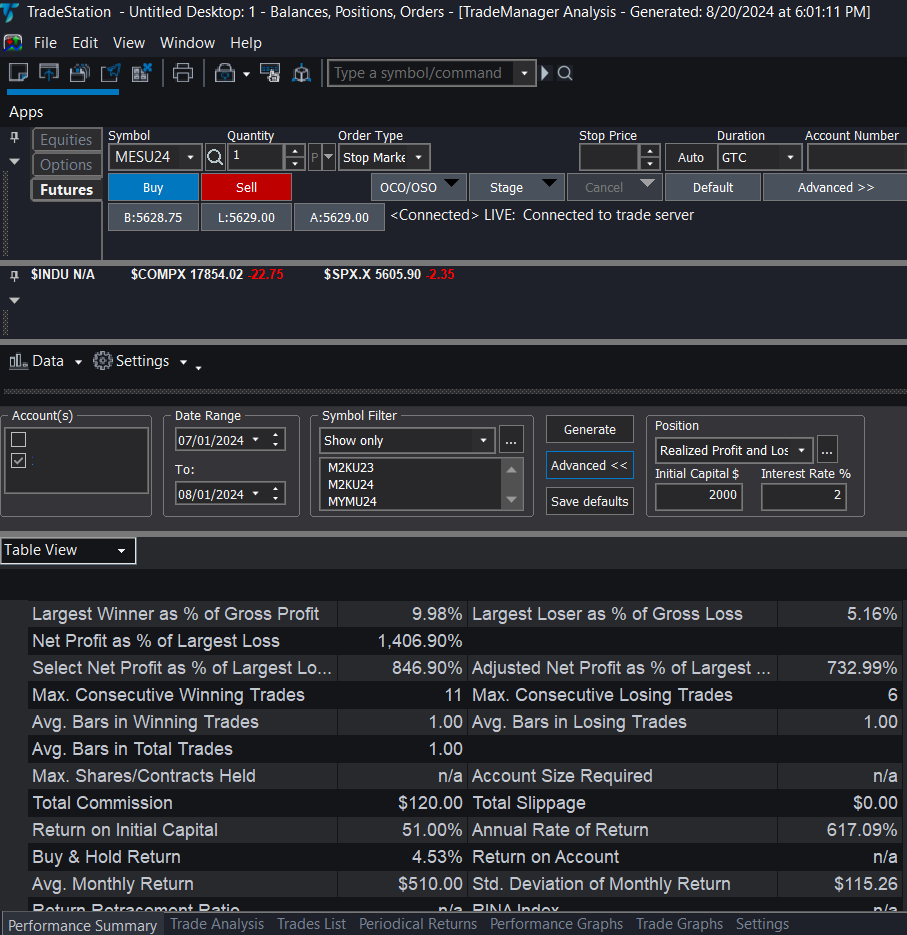

This report will showcase the incubation tests (real money trades, Out-of-sample analysis) with our in-house scalping algos, namely the Gorn SR I, Gorn SRAI I. Two trading tests were run for 2 months in 2023 and 1 month in 2024. This trading system is trading M2K and MYM micro-futures (Russel 2K, DJIA) on CME and CBOT exchange. This system trades LONG only, with position sizing set to one contract for each futures contract, which is worth approx. 1700 USD. The chosen micro futures contracts have a leverage of approx. 20x. Leverage is commonly used by scalping traders in order to magnify gains. The latter trading test in 2024 involves the integration of an additional AI-powered trading layer over the original system.

Setup

Let us examine some aspects of this incubation results of the Gorn scalping flagship algo, Gorn SRAI and its predecessor the Gorn SR. According to our drawdown analysis we will set the starting capital for this trading portfolio at $2000 for both test runs in 2023 and 2024. This will ensure that we fulfill maintenance margin requirements of the broker we trade.

In Gorn we, as a DAO community and company, developed an array of scalping algorithms, for example Gorn SR and Gorn SRAI. Moreover, does the 2023 test run only involves the first iteration of the SR Gorn scalping algo, a mechanical trading system. For the 2024 test run, we have added an additional layer of buy signals, the Gorn SRAI scalping algo.

Furthermore, is the 2023 track record two months worth of M2K and MYM futures trading. The 2024 track record is one month trading of M2K and MYM futures. Both incubation test results are compiled through the trade manager analysis tool inside the tradestation platform, PNL statement and tradestation performance analysis. These reports are important to highlight the systems financial ratios, for example profit factor, return, % profitable trades, profit ratio, return retracement ratio, expectancy value, risk/reward and drawdown.

Results

The most important financial measures to gauge a trading strategy is net profit (return), robustness related ratios and profit factor. The 2023 track record of Gorn SR scalping algo is 30% return over 2 months, with 200 trades and 60% profitable trades. In the 2024 track record we showcase 51% return, 60% profitable trades over 1 month. The coding of the Gorn SR scalping algo remains unchanged since its inception in 2021-2022. CI (Kaizen) is already underway and the Gorn team will release a statement on that front.

Gorn SR Scalping algorithms in action on the M2K and MYM micro fututres traded on CME and CBOT (trading session 23/07/2024)

Performance reports of trading M2K, MYM futures inside Tradestation app

Performance reports of trading M2K, MYM futures inside Tradestation client center