Trading Systems of $GORN DAO

The Gorn Hegemony DAO deploys an portfolio of uncorrelated asset strategies with the aim to outperform the market. Greenlit trading systems that are Operational have undergone various methods for validation, such as walk-forward analysis. Moreover, is Gorn utilizing a vast EasyLanguange (ESL) code repository with strategies, indicators as well as metasystems to improve profitability and trade efficiency of trading systems deployed in the Gorn DAO treasury.

Day after day Gorns and the community come up with new trading ideas that might just have the potential to become a successful trading system. That’s why the community of $GORN and the scally Gorn team work closely together to ignite new ideas into a fully-fledged stratagems. Strategies marked as "Work in Progress" (WIP) are our current research goals. If you have any thoughts, ideas or want to partake in our theorycrafting feel free to reach out to Gorn on Roll, Twitter or Gorn discord.

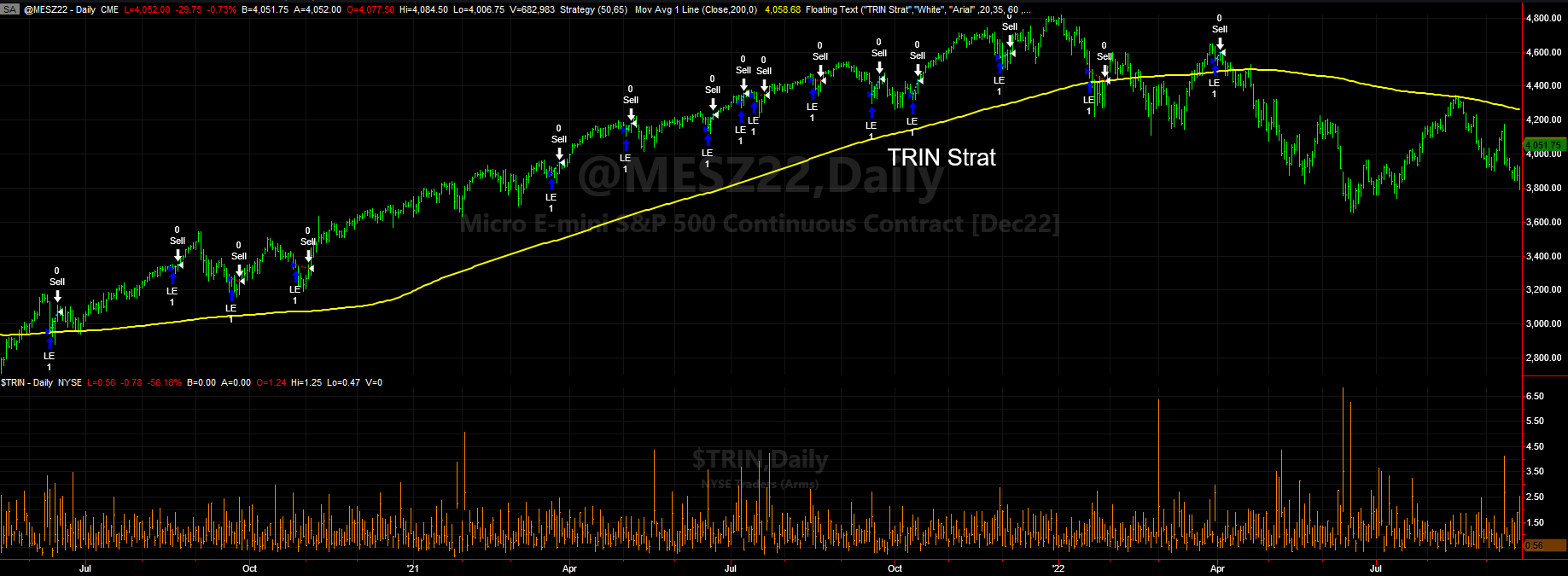

𒀖 Ensemble strategies

TRIN Strategy S&P500 (WIP)

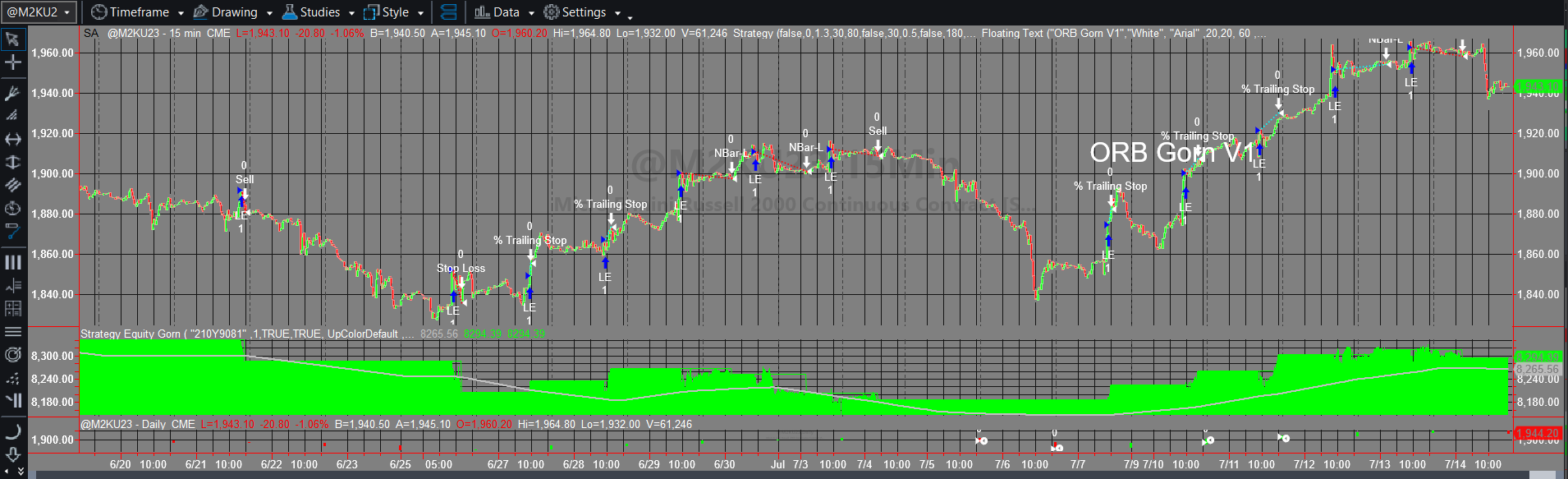

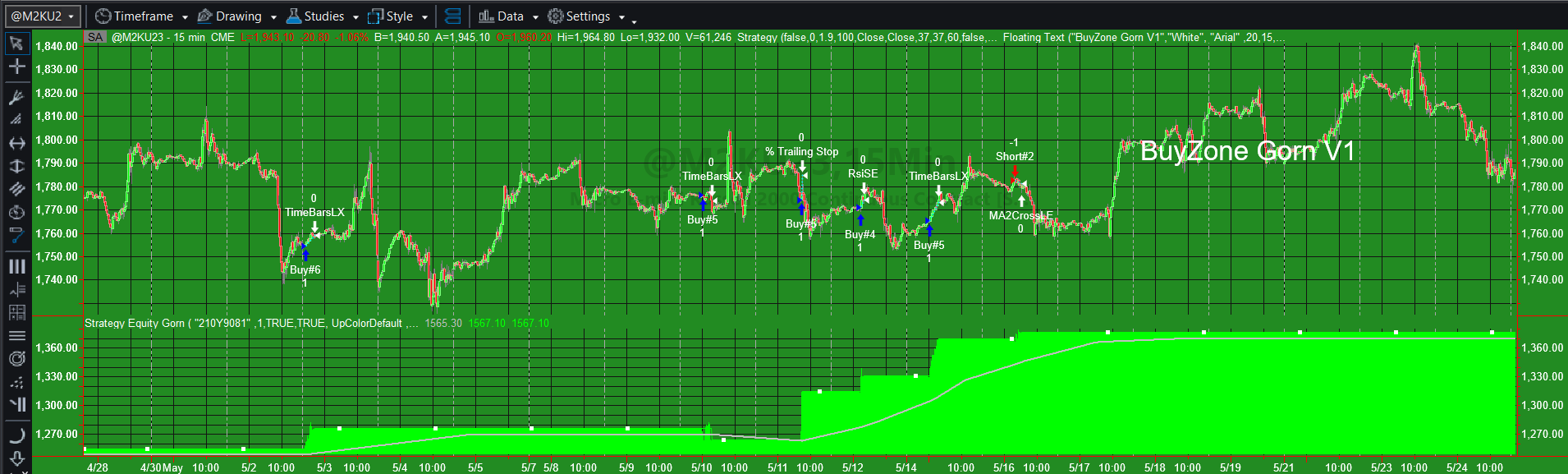

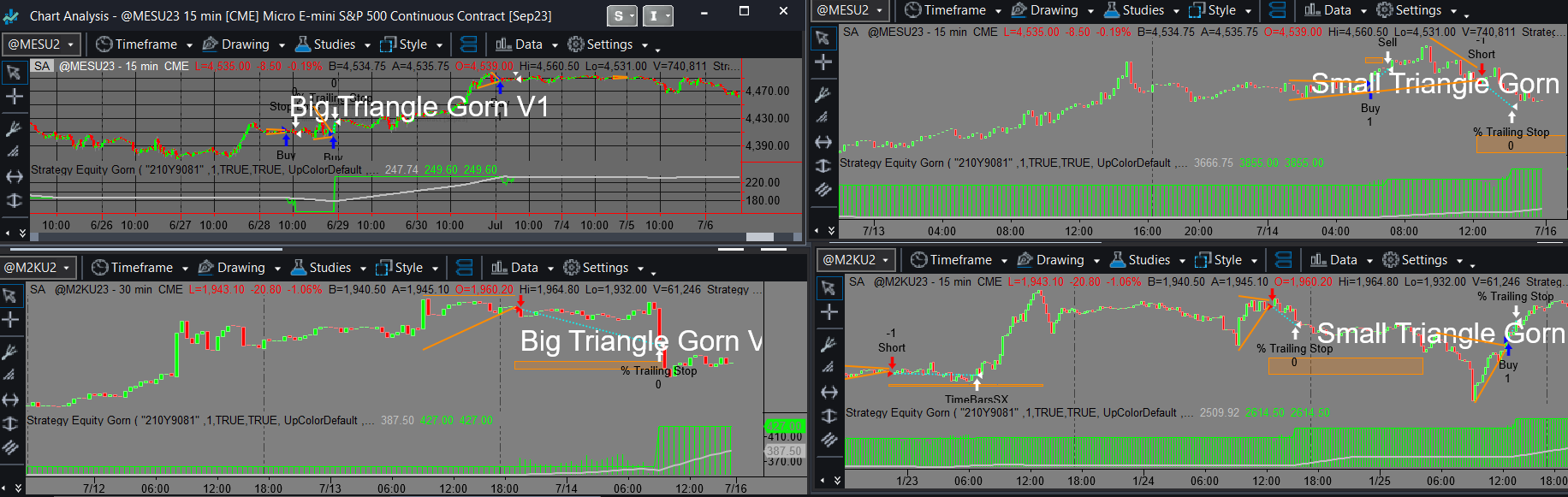

𒀖 Intraday strategies

Gorn Support/Resistance scalping (Operational)

Gorn SR/MACD Swingtrade (Operational)

Range Bound Flag Breakout (WIP)

The Buyzone (WIP)

Triangle Breakout (WIP)

𒀖 Market-neutral strategies

Pairs trade (WIP)

𒀖 Regime-switching strategies

𒀖 Multi-timeframe strategies

2Period RSI by Connor (WIP)

𒀖 Misc. strategies

𒀖 Indicators, scripts and more

Breakeven Stop Gorn Version I (Operational)

Equity Curve Metasystem Gorn Version I (Operational)