DAO Research

Intraday Strategy

Update I - 25/06/2024

Gorn SwingTrade G1 Strategy

incepted by Ryu aka Petar

View on Gitbook:

INDEX

Preface

I. Abstract

II. Strategy Introduction

III. Trading Setup

IV. Strategy 1a and 1b: RSI, IBS, ADX, ORB, MACD

V. Continuous Improvement

VI. Exit Strategy

VII. Strategy 2: Weekly RSI

VIII. Metasystems

IX. Conclusion

In the sprawling 'verse of the Gorn Hegemony DAO, the Gorns had mastered the delicate art of financial warfare. Their sophisticated trading algorithms were well known among interstellar traders, hallmarks of resillience and adaptability. Within the Gorn DAO, a hub of financial innovation and strategy, Gorn Traders were equipped with state-of-the-art Gorn trading tech and research that enabled them to dominate the galactic markets. The financial literacy platform of the Gorn DAO, a marvel of data and insight, was the cornerstone of their success, teaching Gorn Traders how to buidl succefull trading systems and mastering market timing, asset picking and risk management. The intricate interplay of risk and reward is key for understanding the complexity of markets.

Among the elite strategies developed by the Gorn Traders, one has risen from the dark to prominence. Ryu designed the first Gorn swing trade algorithm together with Gorn scientists. Lets take a more thorough look on the semantics of the Gorn swing trading algo, dubbed "Gorn SwingTrade G1".

The first strategic component invovles two trade logics producing one single long signal. Lets also examine risk management and the exit strategy. Initially, the first strategy employes a voting system that integrates RSI, ADX, and IBS indicators on a 15-minute timeframe. This approach ensures that only the most robust signals were acted upon this timeframe. Furthermore, we will utilize the power of the Opening Range Breakout (ORB) to capture early momentum in the market, given the first component of this strat is bullish too. The ORB is a renown breakout strategy. This novel trading system, rooted in Gorn techniques, leveraged the collective strength of multiple indicators to identify lucrative opportunities while minimizing false signals. The ORB strategy component, when triggered, initiated a long position with precision, reflecting the meticulous planning and execution synonymous within Gorn.

The second trading logic that is needed to confirm a signal, a multi-timeframe MACD indicator approach, is another well known and documented setup of indicators. This strategy allocated MACD indicators across various timeframes: 5-minute, 15-minute, 1-hour, and 4-hour charts. Each timeframe captured different market movements, providing a comprehensive view of market trends. This strategy was further refined by backtesting and optimization, ensuring that each parameter was tuned for robustness and excepted value, hence minimizing risk of curve fitting and over-optimization. The Gorn Traders knew that in the vast expanse of the galaxy, adaptability and precision were key to outmaneuvering the market.

Despite their individual strengths, the true power of Gorn techniques was realized when these strategies were combined. The addition of an independent RSI-based strategy, inspired by the legendary trader Kronner, further elevated the expected value of trades as well adding a new layer of robust long signals capturing untapped market opportunities. This combination led to a diverse array of profitable trades, increasing market exposure to a manageable 32%. The integration of these strategies resulted in a metasystem that transcended the capabilities of any single approach, a hallmark of the Gorn Hegemony DAO's strategic brilliance.

The advantages of this metasystem were manifold. By combining multiple strategies, the Gorn Traders achieved a measurable diversification of signals, smoothing out the equity curve and enhancing overall profitability. The use of equity curve trading allowed for dynamic adjustments based on performance, optimizing returns during favorable periods and mitigating risks during downturns. A Volatility-based exit strategy further refined risk management, adapting to the ever-changing market conditions with the foresight of a Gorn tactician.

Other metasystems within the Gorn DAO included dynamic strategy switching, equity curve trading, portfolio rebalancing, and capital growth management techniques like the Kelly Criterion. These sophisticated methods ensured that the Gorn Hegemony DAO maintained its edge in the fiercely competitive realm of interstellar trading.

In the heart of the financial literacy platform of Gorn DAO, Gorn Traders were continually honing their skills, learning to navigate the complexities of the market with ever-increasing proficiency. The Gorn Hegemony DAO stood as a beacon of financial mastery, its traders revered across the galaxy for their unmatched expertise and strategic acumen. Through meticulous application of state-of-the-art Gorn algorithms and technical analysis techniques, the Gorns ensured the DAO will propser in the financial cosmos, their legacy etched in the 'verse, metaverse to multiverse.

Strategy Introduction

Gorn SwingTrade G1, an algorithmic trading strategy will be deployed on the Russel 2000 small cap index fund, using the M2K micro futures on CME exchange. It combines 2 distinct LONG triggers, an intraday voting strategy as well as a weekly RSI based strategy. Due to its simplicity of using traditional indicators the system can be applied to other assets as well. Another example we highlight is the Gorn Swing G1 applied to the SP500 index fund futures (MES). The parameters shouldnt be changed when applied to another asset, except running the backtesting, OOS testing, walk forward analysis, money managment, and then adjusting position sizing, targets, stops (optimize the volatility based stops based on impactful fitness functions. Examples could be robustness value, expected value or any adjusted risk/reward ratio (for example TS index on Tradestation, or return retracement value, sharpe ratio). This is where the skills and experience of an algorithmic trader Gorn come into play. Knowledge, wisdom, resillience, adaptability and discipline are the foundation of a Gorn trader.

.

Among the elite strategies developed by the Gorn Traders, one has risen from the dark to prominence. Ryu designed the first Gorn swing trade algorithm together with Gorn scientists. Lets take a more thorough look on the semantics of the Gorn swing trading algo, dubbed "Gorn SwingTrade G1".

The first strategic component invovles two trade logics producing one single long signal. Lets also examine risk management and the exit strategy. Initially, the first strategy employes a voting system that integrates RSI, ADX, and IBS indicators on a 15-minute timeframe. This approach ensures that only the most robust signals were acted upon this timeframe. Furthermore, we will utilize the power of the Opening Range Breakout (ORB) to capture early momentum in the market, given the first component of this strat is bullish too. The ORB is a renown breakout strategy. This novel trading system, rooted in Gorn techniques, leveraged the collective strength of multiple indicators to identify lucrative opportunities while minimizing false signals. The ORB strategy component, when triggered, initiated a long position with precision, reflecting the meticulous planning and execution synonymous within Gorn.

The second trading logic that is needed to confirm a signal, a multi-timeframe MACD indicator approach, is another well known and documented setup of indicators. This strategy allocated MACD indicators across various timeframes: 5-minute, 15-minute, 1-hour, and 4-hour charts. Each timeframe captured different market movements, providing a comprehensive view of market trends. This strategy was further refined by backtesting and optimization, ensuring that each parameter was tuned for robustness and excepted value, hence minimizing risk of curve fitting and over-optimization. The Gorn Traders knew that in the vast expanse of the galaxy, adaptability and precision were key to outmaneuvering the market.

Despite their individual strengths, the true power of Gorn techniques was realized when these strategies were combined. The addition of an independent RSI-based strategy, inspired by the legendary trader Kronner, further elevated the expected value of trades as well adding a new layer of robust long signals capturing untapped market opportunities. This combination led to a diverse array of profitable trades, increasing market exposure to a manageable 32%. The integration of these strategies resulted in a metasystem that transcended the capabilities of any single approach, a hallmark of the Gorn Hegemony DAO's strategic brilliance.

The advantages of this metasystem were manifold. By combining multiple strategies, the Gorn Traders achieved a measurable diversification of signals, smoothing out the equity curve and enhancing overall profitability. The use of equity curve trading allowed for dynamic adjustments based on performance, optimizing returns during favorable periods and mitigating risks during downturns. A Volatility-based exit strategy further refined risk management, adapting to the ever-changing market conditions with the foresight of a Gorn tactician.

Other metasystems within the Gorn DAO included dynamic strategy switching, equity curve trading, portfolio rebalancing, and capital growth management techniques like the Kelly Criterion. These sophisticated methods ensured that the Gorn Hegemony DAO maintained its edge in the fiercely competitive realm of interstellar trading.

In the heart of the financial literacy platform of Gorn DAO, Gorn Traders were continually honing their skills, learning to navigate the complexities of the market with ever-increasing proficiency. The Gorn Hegemony DAO stood as a beacon of financial mastery, its traders revered across the galaxy for their unmatched expertise and strategic acumen. Through meticulous application of state-of-the-art Gorn algorithms and technical analysis techniques, the Gorns ensured the DAO will propser in the financial cosmos, their legacy etched in the 'verse, metaverse to multiverse.

Strategy Introduction

Gorn SwingTrade G1, an algorithmic trading strategy will be deployed on the Russel 2000 small cap index fund, using the M2K micro futures on CME exchange. It combines 2 distinct LONG triggers, an intraday voting strategy as well as a weekly RSI based strategy. Due to its simplicity of using traditional indicators the system can be applied to other assets as well. Another example we highlight is the Gorn Swing G1 applied to the SP500 index fund futures (MES). The parameters shouldnt be changed when applied to another asset, except running the backtesting, OOS testing, walk forward analysis, money managment, and then adjusting position sizing, targets, stops (optimize the volatility based stops based on impactful fitness functions. Examples could be robustness value, expected value or any adjusted risk/reward ratio (for example TS index on Tradestation, or return retracement value, sharpe ratio). This is where the skills and experience of an algorithmic trader Gorn come into play. Knowledge, wisdom, resillience, adaptability and discipline are the foundation of a Gorn trader.

.

Trading Setup

The M2K micro futures contract will be used to trade this 2 strategies:

- 1 LONG contract traded per strategy (scaling to 2 orders max since 2 strategies are used simulatnously)

- Contract unit:

5$ x Russel 2000 Index Fund (5 x 2000 = 10 000 USD position size 1 contract)

- Cost ~500 USD per contract (~20x leverage)

- Fees, Slippage 2 USD

Strategy 1, Component 1:

Voting strategy: RSI, ADX, IBS, ORB

- Voting System: Check the RSI, ADX, and IBS indicators on a 15-minute timeframe. If any one of them is bullish, proceed to the next step.

- ORB Strategy: Apply an Opening Range Breakout (ORB) strategy with a 1.44 setting on the chart. When the ORB signal triggers, a long position is initiated.

Advantages:

1. Multiple Confirmations: Using RSI, ADX, and IBS provides a robust confirmation mechanism, reducing the likelihood of false signals and increasing the probability of successful trades.

2. Adaptability: The strategy adapts to various market conditions by leveraging different indicators that capture momentum (RSI), trend strength (ADX), and market extremes (IBS).

3. Early Entry: The ORB strategy facilitates early entry into potential breakouts, allowing traders to capitalize on significant intraday moves.

Strategy 1, Component 2:

Multi-Timeframe MACD Strategy

This strategic component delivers a comprehensive view of the market on multiple timeframes. MACD itself stands for moving average convergence/divergence indicator and was created by Gerald Appel. This technical analysis tool shows the relationship of 2 moving averages of a asset price with the aim of trend idenfitcation.

Suggested MACD Timeframes and Parameters:

1. 5-minute: MACD (5, 3)

2. 15-minute: MACD (13, 5)

3. 1-hour: MACD (26, 12)

4. 4-hour: MACD (30, 9)

Alternative Parameters for Testing (recommended by ChatGTP 4o):

1. 5-minute: MACD (6, 3)

2. 15-minute: MACD (14, 5)

3. 1-hour: MACD (25, 10)

4. 4-hour: MACD (35, 9)

Implementation:

- Backtesting and Optimization: Test each MACD setting on historical data and optimize parameters for best performance metrics.

- Multi-Timeframe Confirmation: Ensure alignment of MACD signals across multiple timeframes before entering a trade. For example, all MACDs across all timeframes hav e to align in order to trigger a long signal.

Advantages:

1. Trend Identification: Using multiple timeframes helps identify and confirm trends with greater accuracy, improving the timing of entries and exits.

2. Signal Filtering: The combination of fast, intermediate, and slow MACDs filters out market noise and reduces the likelihood of false signals.

3. Comprehensive Market View: Analyzing different timeframes provides a broader perspective of the market, capturing both short-term and long-term trends.

4. Flexibility in Trade Management: The strategy allows for dynamic trade management, adapting to different market conditions and improving the overall performance.

By combining these strategies with the well-defined exit strategy, traders can achieve a balanced approach that optimizes profit potential while managing risks effectively.

Continous Improvement of Strategy 1: Voting System

Improving the two strategies mentioned involves a combination of further optimization, rigorous testing, and refining entry and exit conditions to enhance overall performance. Here are specific steps for each strategy:

Strategy 1a: Voting System with RSI, ADX, IBS, and ORB

1. Optimize Indicator Parameters:

- RSI: Experiment with different periods (e.g., 10, 14, 20) to find the most responsive settings for the 15-minute timeframe.

- ADX: Adjust the ADX threshold for determining trend strength (e.g., 20, 25, 30) to filter out weak trends more effectively.

- IBS: Test different thresholds for IBS to identify overbought and oversold conditions more accurately.

2. Refine Voting Logic:

- Consider adding weights to each indicator based on their historical performance. For instance, if RSI has shown more reliable signals, it could have a higher weight in the voting system.

3. Improve ORB Settings:

- Adjust the ORB settings (e.g., 1.44 setting) by testing different breakout levels and timeframes to find the optimal configuration that captures significant price moves.

4. Backtesting and Forward Testing:

- Conduct extensive backtesting on historical data to assess the performance of the optimized parameters. Out-of-sample testing is very important too. Aim here is to find parameters with robust and high expected value strategy stats.

- Follow up with forward testing in a simulated environment to validate the strategy under current market conditions. There are many platforms where u can do analysis like, tradingview, chatgtp 4, tradestation, autochart or search on the web for other platforms.

5. Add Additional Filters:

- Introduce filters such as volume spikes (some Gorn algos use that), time-of-day considerations (every Gorn algo uses it), or market sentiment indicators to improve the quality of trade signals.

Strategy 1b: Multi-Timeframe MACD Strategy

1. Optimize MACD Settings:

- Fine-tune the MACD parameters (e.g., fast, slow, and signal periods) for each timeframe to enhance signal accuracy. Use historical data to identify the best-performing settings.

2. Enhance Multi-Timeframe Confirmation:

- Implement stricter rules for multi-timeframe alignment. For example, require confirmation from an additional timeframe (e.g., the 30-minute chart) before taking a trade.

3. Dynamic Position Sizing:

- Incorporate dynamic position sizing based on volatility or the strength of the signal. For example, increase position size when higher timeframes confirm the trend strongly.

4. Improve Exit Strategies:

- Test various exit strategies such as trailing stops, partial profit-taking at certain profit levels, or time-based exits to optimize trade outcomes.

5. Backtesting and Forward Testing:

- Perform thorough backtesting to evaluate the performance of the refined MACD settings and exit strategies.

- Proceed with forward testing in a demo account or with small position sizes to ensure robustness in live trading conditions.

Exit Strategy

Components:

1. Stop Loss: $70

2. Breakeven Stop Order: Trigger at $100 profit, place limit order at entry price + $1.

3. Trailing Stop Order: Trigger at $700 profit, place a limit sell order at -10% of the price (alternatively a volatility based stop can be used)

4. Profit Target: Place a market order at $1400 profit.

5. Volatility-based stop order (Using ATR to determine optimal market timing for exit, 3 targets are calculated)

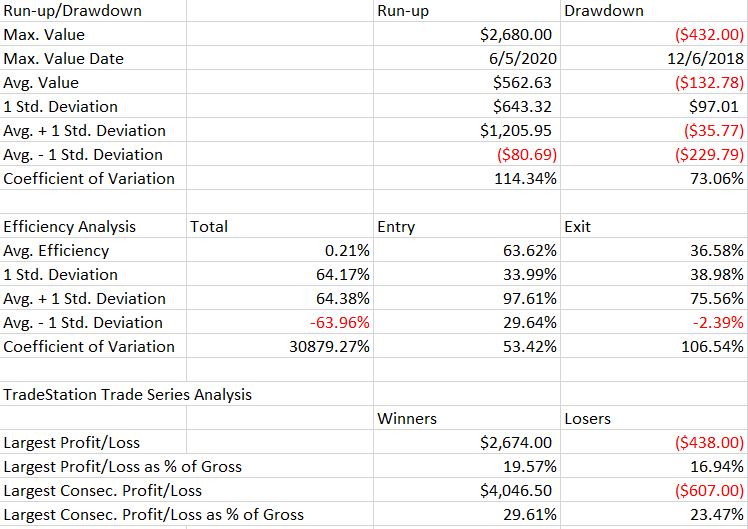

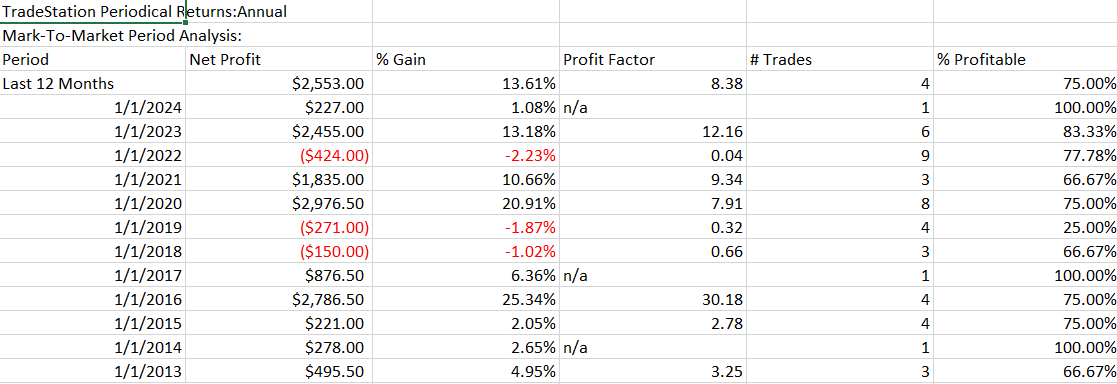

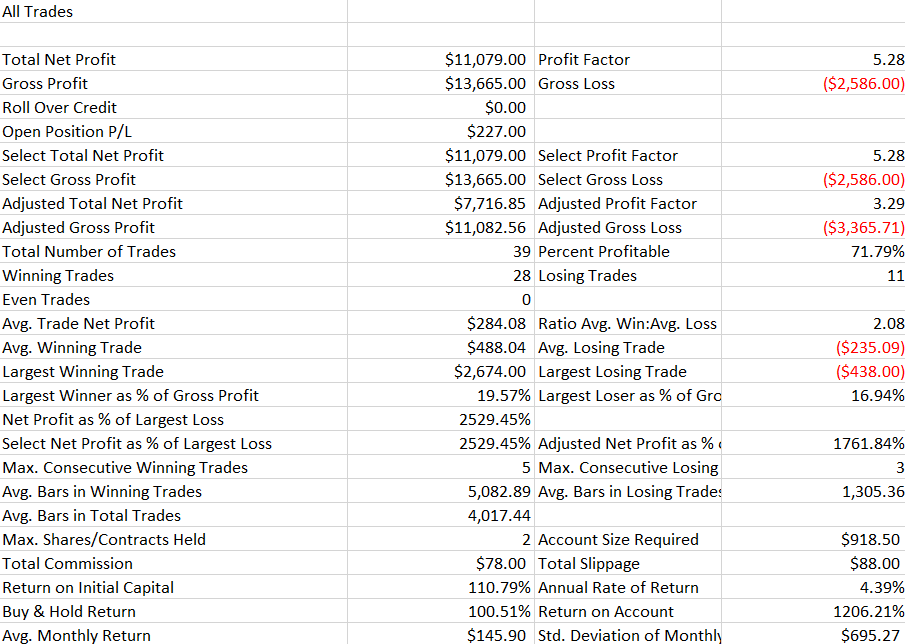

6. Drawdown analysis has been done, as well as walk-forward analysis to verify robustness of the strategy and its parameters.

Advantages of this Exit Strategy:

1. Risk Management: The stop loss of $70 ensures that potential losses are capped, protecting the trading capital from significant drawdowns.

2. Profit Protection with Breakeven: Triggering a breakeven stop order at $100 profit and setting a limit order at entry + $1 helps secure initial gains, minimizing the risk of turning a winning trade into a losing one.

3. Trailing Stop for Larger Gains: The trailing stop order at $700 profit helps lock in substantial gains while allowing the position to capture more upside potential. The limit sell order at -10% of the price ensures that the gains are preserved even if the market reverses.

3a. Alternatively a Volatility based stop order, profit target can be used.

4. Clear Profit Target: A market order at $1400 profit provides a clear and defined exit point for highly successful trades, ensuring that substantial profits are realized. On the other hand a volatility based profit target system could be utilized instead.

Conclusion Strategy 1

We have now examined the smantics of both, Gorn Swing G1 Strategy 1+2: a Voting System with RSI, ADX, IBS, and ORB combined with a Multi-timeframe MACD strategy. Let us now examine an independent weekly RSI strategy, which produces its own long signal within the trading system Gorn SwingTrade G1.

Strategy 2: Weekly RSI

The weekly RSI strategy Gorn uses is based on renown "RSI with RSI" trading strategy by Peter Konner. By adding a weekly chart strategy 3 in our strategy 1+2 chart we are available to capture more trade opportunities. RSI itself stands for relative strenght index, which highlights overbought and oversold market situations. Furthermore, does the backtesting reveal that this strategy increases market exposure to 32% and profitability.

Combining Strategies

1. Diversification of Signals:

- Combining the weekly RSI-based strategy with the existing strategies (voting system with RSI, ADX, IBS, and ORB, and multi-timeframe MACD) diversifies the sources of trading signals. This reduces reliance on any single indicator and can smooth out the equity curve by providing more frequent and varied trade opportunities. The core idea behind this is Ocams Razor, keepin it simple. According to researched, adding nonlinearty to the system improves robustness when applied on forward testing or live markets.

2. Increased Expected Value:

- By backtesting, OOS testing, forward testing it was found that the expected value of trades increased. This indicates that combining the strategies produces more profitable trades overall. The combined strategy can capitalize on different market conditions, thus enhancing profitability.

3. Reduced Time Exposure:

- With a market exposure of around 32%, the combined strategies spend less time in the market, reducing the risk associated with prolonged exposure. This is beneficial in volatile markets, where reduced exposure can limit potential losses during adverse conditions.

4. Complementary Strengths:

- Each strategy may excel in different market conditions. For instance, the RSI-based strategy might perform well in ranging markets, while the multi-timeframe MACD might capture trends more effectively. This complementary nature ensures that the combined system can perform well across various market environments.

5. Improved Risk Management:

- Using the same risk management and exit strategies for both independent strategies ensures consistency in handling risk. This standardization helps maintain a clear and disciplined approach to managing trades.

Advantages of this Exit Strategy:

1. Risk Management: The stop loss of $70 ensures that potential losses are capped, protecting the trading capital from significant drawdowns.

2. Profit Protection with Breakeven: Triggering a breakeven stop order at $100 profit and setting a limit order at entry + $1 helps secure initial gains, minimizing the risk of turning a winning trade into a losing one.

3. Trailing Stop for Larger Gains: The trailing stop order at $700 profit helps lock in substantial gains while allowing the position to capture more upside potential. The limit sell order at -10% of the price ensures that the gains are preserved even if the market reverses.

3a. Alternatively a Volatility based stop order, profit target can be used.

4. Clear Profit Target: A market order at $1400 profit provides a clear and defined exit point for highly successful trades, ensuring that substantial profits are realized. On the other hand a volatility based profit target system could be utilized instead.

Conclusion Strategy 1

We have now examined the smantics of both, Gorn Swing G1 Strategy 1+2: a Voting System with RSI, ADX, IBS, and ORB combined with a Multi-timeframe MACD strategy. Let us now examine an independent weekly RSI strategy, which produces its own long signal within the trading system Gorn SwingTrade G1.

Strategy 2: Weekly RSI

The weekly RSI strategy Gorn uses is based on renown "RSI with RSI" trading strategy by Peter Konner. By adding a weekly chart strategy 3 in our strategy 1+2 chart we are available to capture more trade opportunities. RSI itself stands for relative strenght index, which highlights overbought and oversold market situations. Furthermore, does the backtesting reveal that this strategy increases market exposure to 32% and profitability.

Combining Strategies

1. Diversification of Signals:

- Combining the weekly RSI-based strategy with the existing strategies (voting system with RSI, ADX, IBS, and ORB, and multi-timeframe MACD) diversifies the sources of trading signals. This reduces reliance on any single indicator and can smooth out the equity curve by providing more frequent and varied trade opportunities. The core idea behind this is Ocams Razor, keepin it simple. According to researched, adding nonlinearty to the system improves robustness when applied on forward testing or live markets.

2. Increased Expected Value:

- By backtesting, OOS testing, forward testing it was found that the expected value of trades increased. This indicates that combining the strategies produces more profitable trades overall. The combined strategy can capitalize on different market conditions, thus enhancing profitability.

3. Reduced Time Exposure:

- With a market exposure of around 32%, the combined strategies spend less time in the market, reducing the risk associated with prolonged exposure. This is beneficial in volatile markets, where reduced exposure can limit potential losses during adverse conditions.

4. Complementary Strengths:

- Each strategy may excel in different market conditions. For instance, the RSI-based strategy might perform well in ranging markets, while the multi-timeframe MACD might capture trends more effectively. This complementary nature ensures that the combined system can perform well across various market environments.

5. Improved Risk Management:

- Using the same risk management and exit strategies for both independent strategies ensures consistency in handling risk. This standardization helps maintain a clear and disciplined approach to managing trades.

Metasystems

Metasystems are defined as systems that analyse systems. We will use a simple equity curve metasystem to augment the robustness and profitability of our trading system.

Advantages of a Metasystem

1. Equity Curve Trading:

- Trading based on the equity curve involves adjusting trading intensity or switching strategies based on the performance of the combined equity curve. This can help in optimizing returns by increasing trade sizes during favorable periods and reducing exposure during drawdowns.

2. Dynamic Allocation:

- A metasystem can dynamically allocate capital between the combined strategies based on their performance. This ensures that more capital is allocated to the better-performing strategy at any given time, optimizing overall returns.

3. Risk Reduction through Non-correlation:

- The combined strategies may not be perfectly correlated, meaning their drawdowns might not occur simultaneously. This non-correlation helps in reducing overall portfolio risk and volatility, creating a smoother equity curve.

4. Improved Statistical Robustness:

- Combining multiple strategies and using a metasystem improves the statistical robustness of the trading system. It diversifies the sources of returns and reduces the risk of overfitting any single strategy to historical data.

Recommended Metasystems

1. Equity Curve Control:

- As mentioned, equity curve trading adjusts trading intensity based on the equity curve's performance. If the equity curve is trending upwards, the system increases position sizes; if it’s in a drawdown, the system reduces or pauses trading to prevent further losses. Gorn has developed the Gorn EQcurve, a equity curve trading system on EasyLanguage coding. It essentially is a tool manage a portfolio of trading strategies.

2. Volatility-Based Position Sizing, Stops, Targets:

- Adjust position sizes, stops or targets based on market volatility. During high volatility periods, reduce position sizes to limit risk, increase targets; during low volatility periods, increase position sizes to maximize returns on stable trends, decrease targets.

3. Strategy Switching:

- Implement a rule-based system to switch between strategies based on predefined conditions. For example, if the RSI-based strategy underperforms over a certain period, the system can switch to the Voting+MACD strategy, or vice versa. Another idea could be using the equity curves of strategies to decide the switching.

4. Portfolio Rebalancing:

- Regularly rebalance the allocation of capital between the strategies. For instance, monthly or quarterly rebalancing can ensure that each strategy is given appropriate weight based on recent performance and market conditions.

5. Capital Growth and Risk Management:

- Use techniques such as the Kelly Criterion to dynamically adjust the fraction of capital allocated to each strategy based on their past performance and expected returns, optimizing capital growth while managing risk. Examine reinvestment risk, currency risk, fees, slippage and counter-party risk of your trading project.

Conclusion

Combining the two independent strategies enhances the trading system by leveraging the strengths amd synergies of each strategy and providing a more balanced approach to different market conditions. Moreover, is the chosen asset the Russel 2k small cap index, which is diversified. Using a metasystem, for example the Gorn EQcurve, further improves market timing by dynamically managing risk andvcomprehending markets on different timeframes and optimizing capital allocation. This approach increases the robustness, consistency, and profitability of the trading system, making it better suited for live market conditions

1. Equity Curve Trading:

- Trading based on the equity curve involves adjusting trading intensity or switching strategies based on the performance of the combined equity curve. This can help in optimizing returns by increasing trade sizes during favorable periods and reducing exposure during drawdowns.

2. Dynamic Allocation:

- A metasystem can dynamically allocate capital between the combined strategies based on their performance. This ensures that more capital is allocated to the better-performing strategy at any given time, optimizing overall returns.

3. Risk Reduction through Non-correlation:

- The combined strategies may not be perfectly correlated, meaning their drawdowns might not occur simultaneously. This non-correlation helps in reducing overall portfolio risk and volatility, creating a smoother equity curve.

4. Improved Statistical Robustness:

- Combining multiple strategies and using a metasystem improves the statistical robustness of the trading system. It diversifies the sources of returns and reduces the risk of overfitting any single strategy to historical data.

Recommended Metasystems

1. Equity Curve Control:

- As mentioned, equity curve trading adjusts trading intensity based on the equity curve's performance. If the equity curve is trending upwards, the system increases position sizes; if it’s in a drawdown, the system reduces or pauses trading to prevent further losses. Gorn has developed the Gorn EQcurve, a equity curve trading system on EasyLanguage coding. It essentially is a tool manage a portfolio of trading strategies.

2. Volatility-Based Position Sizing, Stops, Targets:

- Adjust position sizes, stops or targets based on market volatility. During high volatility periods, reduce position sizes to limit risk, increase targets; during low volatility periods, increase position sizes to maximize returns on stable trends, decrease targets.

3. Strategy Switching:

- Implement a rule-based system to switch between strategies based on predefined conditions. For example, if the RSI-based strategy underperforms over a certain period, the system can switch to the Voting+MACD strategy, or vice versa. Another idea could be using the equity curves of strategies to decide the switching.

4. Portfolio Rebalancing:

- Regularly rebalance the allocation of capital between the strategies. For instance, monthly or quarterly rebalancing can ensure that each strategy is given appropriate weight based on recent performance and market conditions.

5. Capital Growth and Risk Management:

- Use techniques such as the Kelly Criterion to dynamically adjust the fraction of capital allocated to each strategy based on their past performance and expected returns, optimizing capital growth while managing risk. Examine reinvestment risk, currency risk, fees, slippage and counter-party risk of your trading project.

Conclusion

Combining the two independent strategies enhances the trading system by leveraging the strengths amd synergies of each strategy and providing a more balanced approach to different market conditions. Moreover, is the chosen asset the Russel 2k small cap index, which is diversified. Using a metasystem, for example the Gorn EQcurve, further improves market timing by dynamically managing risk andvcomprehending markets on different timeframes and optimizing capital allocation. This approach increases the robustness, consistency, and profitability of the trading system, making it better suited for live market conditions